You are reading:

Faster, Easier & More Convenient Way to Form Your Company

- Company Setup -

Faster, Easier & More Convenient Way to Form Your Company

If you're one of the entrepreneurs who are looking forward to starting up their businesses or using Hong Kong as a stepping stone to unlocking the opportunities in Asia, it's best to find a trustworthy consultant who provides appropriate advice, and takes care of the whole application process with great attention like BRIDGES. Read on to see how your start-up venture can be aided by experienced and skillful business consultants in this article.

FASTER >> to Form All-New Limited Company

Whether you would like to set up an all-new company, or purchase a ready-made one as your HK business vehicle, the incorporation process can be as fast as 2 working days. Before it used to take almost 10 days to finish setting up an all-new company but now with our 2 DAYS EXPRESS services, your company can be up and running in a much shorter time.

Since most HK banks require clients to make the account opening bookings around 1 month in advance, our consultants will help you make the bank appointments straightway once your company is being set up (in 2 days as mentioned above) to speed up the whole process and let you operate with a corporate bank account as soon as possible.

Not in HK or can't travel? Not a problem! Due to COVID-19, our team sees some clients aren't able to travel because of lockdown, we, therefore, can help incorporate a business remotely. We also have partnered up with several renowned online finance platforms which allow clients to open a corporate bank account within 48 hours even they can't be in HK.

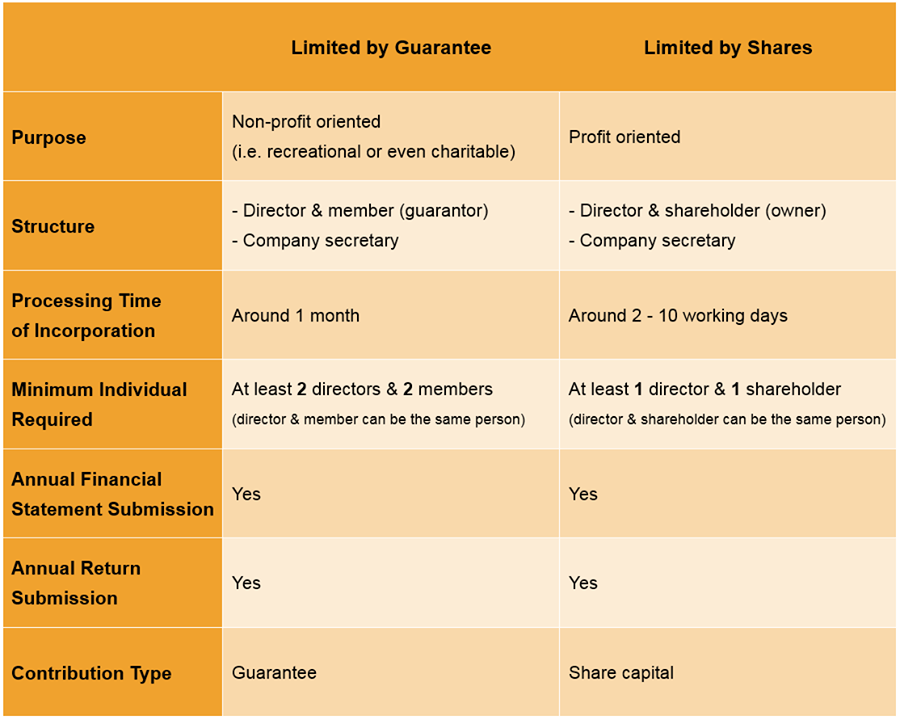

EASIER >> to Set up Your Business with Only 1 Person

When considering gaining a foothold in Asia, it's always a struggle between HK and Singapore. Yet, the flexibility of the former city is probably one of the biggest advantages for foreigners to take and start their business here as the first stop in Asia. As forming a Singapore company requires foreign entrepreneurs to partner up with a local Singapore citizen, there is no limit on the nationality of the Director(s) and Shareholder(s) in setting up a HK company. It means regardless of your nationality, you are free to form your own company in HK without including a HK citizen as your company’s stakeholder, giving you higher flexibility in the company structure.

Not to mention it takes only one person to form the HK company (meaning the Director and Shareholder can even be the same person), and the mandatory Company Secretary can be provided by us which is already included in our all-in-one HK Company Formation Package.

MORE CONVENIENT >> to Open HK Bank Account

One final step before actually running your venture - opening a corporate bank account. However, this is the most crucial yet painful process that can be an obstacle since many applicants aren't familiar with what and how to catch up with ever-changing bank compliance. The assessment criteria of opening a bank account are also getting more rigorous to prevent illegal operations. Hence, our experienced consultant can uplift the account opening success rate for clients with the intensive know-how and extensive banking network. For more details, please refer to ‘How Your Bank Acc. Opening Success Rate Is Raised by a Skillful Consultant’.

The high global ranking on banking and financial infrastructure. the secured monetary system, well-established legal regime and free currency exchange circulation of HK (especially when compared with mainland cities) are the powerful basis for every business, and that’s why many savvy entrepreneurs have picked HK as their base in Asia.

=============================================================================

Get the support of BRIDGES' on-site advisory team who will save your various hassles so your venture in HK will guarantee to be a successful one.

Shoot us an email at info@bridges.hk or call +852 2159 9666 to get our practical advice and kickstart your HK business journey as soon as possible!

.jpg)

Mon - Fri : 9:00 - 18:00

Mon - Fri : 9:00 - 18:00