You are reading:

How Our Knowledgeable Consultant Will Help Increase Your Bank Account Opening Success Rate

- Start-Up Support -

How Our Knowledgeable Consultant Will Help Increase Your Bank Account Opening Success Rate

Many business owners must have heard about the infamously arduous bank account opening process in HK and we often encounter foreign entrepreneur clients stressing about it. With all the travel restrictions, it seems to make opening a corporate bank account even trickier since many business owners cannot be present. However, our team has helped almost 20 business owners of different nationalities to open an account remotely successfully in the first half of 2022!

Here comes how our team can make the entire journey much more efficient even if the client is not in HK with practical advice and initiatives.

It is no secret that the bank account regulations of international banks are tightening over time to prevent illegal operations, that is when our in-house compliance team and experienced advisor come in handy. Our local experts will always provide detailed guidance and solutions for clients to adapt the regulations, making the success rate naturally higher.

Why Having a Consultant is Important?

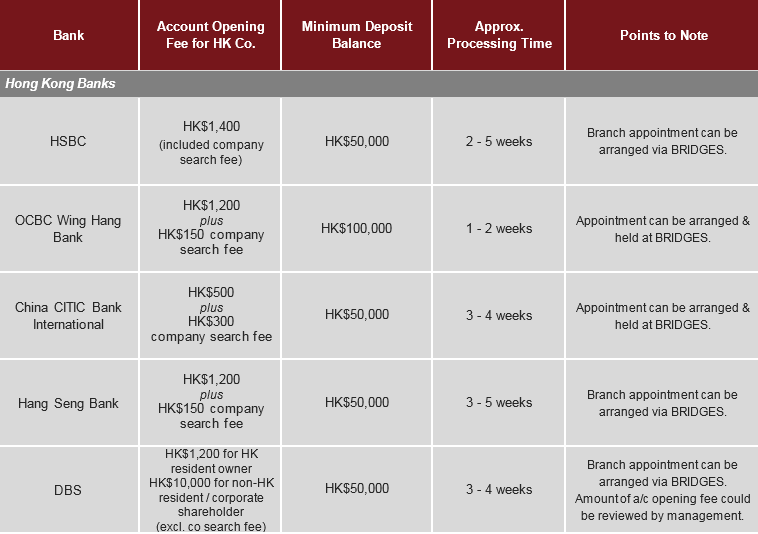

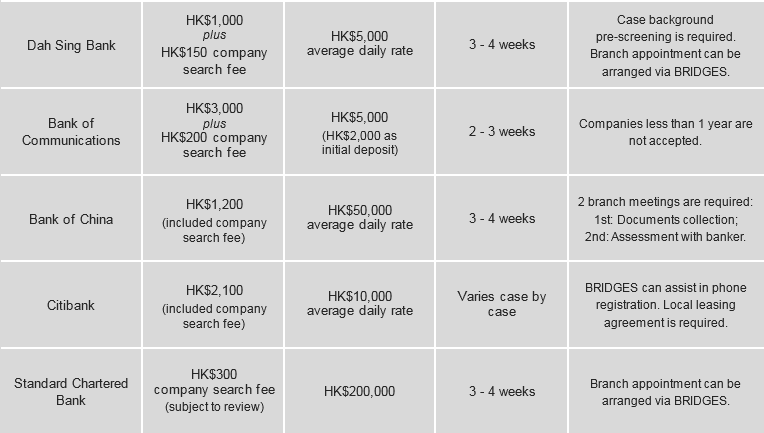

Our competent consultant does not stop at telling you what documents are needed beforehand, s/he will also review your documents and provide practical suggestions to facilitate your application. Based on each client's background and needs (i.e. business nature, passport country, residence country, buyer & supplier background, etc.), our consultant will suggest the most suitable bank(s) for your business as some banks fit some business natures better, or how to enhance your prepared documents to fit the banks’ particular requirements.

After the official documents are submitted and the appointment with bankers is confirmed, the consultant will then notify you so you can meet with the banks virtually or physically (banks like HSBC and OCBC now offer virtual meetings to cater to applicants who can't do it in person due to travel restrictions), and pick up the registered company materials such as business registration certificate (which can also be done by our team). In short, our team will do our very best to step in at the right time and set things up in the most efficient way.

How We Can Make a Difference?

Many clients are extremely concerned if they could open a bank account remotely due to travel restrictions and questions about the success rate, you can see how we will help at different start-up stages in the following.

- Company incorporation stage: After receiving your company details and ID proofs, our consultants will prepare a set of registration documents for you to sign online and then we'll submit them to the relevant Government departments. Most importantly, you do NOT have to be in HK and everything is done digitally.

- Bank account opening stage: To save your hassles, our team will manage the appointments with your preferred banks. Some of our bank partners can even offer pre-screening to let you know whether your provided documents are sufficient for the bank appointment / assessment.

We fully understand that each client’s case background is different and some banks could be more suitable for certain businesses. For instance, some banks might require all Director(s) and Shareholder(s) to be present at the meeting, whilst some banks only need half of them to show up. Read this if you are interested to know more about the requirements of each of our bank partners.

=============================================================================

If you want to have more information or need any assistance in opening a bank account, don't hesitate to shoot us an email at info@bridges.hk or call us at +852 2159 9666 and enjoy your exciting business journey with us.

.jpg)

Mon - Fri : 9:00 - 18:00

Mon - Fri : 9:00 - 18:00